1. Fidelity's Planning and Direction Heart allows you to build and keep an eye on various impartial financial aims. Whilst there isn't a charge to crank out a system, expenditures billed by your investments and also other fees related with trading or transacting in your account would however use.

This materials has actually been distributed for general academic/informational functions only and shouldn't be regarded as investment guidance or simply a recommendation for any certain security, tactic or investment products, or as customized investment guidance.

These traders could have to simply accept reduce prolonged-term returns, as lots of bonds—especially substantial-excellent concerns—generally Really don't offer you returns as substantial as stocks more than the long run. Nonetheless, Notice that some fastened income investments, like substantial-generate bonds and specific Global bonds, can supply A lot better yields, albeit with extra risk.

Worth you could expect from Schwab. For more than 50 a long time, Schwab has become there for investors through very good occasions and undesirable. Our shopper-1st approach implies that what ever comes your way right now, we will always be invested in your tomorrow.

Considering that 1849, Comerica has been increasing the anticipations of what a lender is often. Our shopper-centric planning-based method of Personal Wealth Management surrounds you with a staff of experienced planners, strategists and advisors, Every committed to collaborating with both you and your crew of advisors to deliver the best solutions for your specific objectives, ambitions and priorities sent through the concierge-fashion company you are worthy of.

Understand that investing will involve risk. The value of your investment will fluctuate as time passes, and you might acquire or drop dollars.

When you’re married therefore you or your spouse doesn’t get the job done or earns substantially lower than the other, a spousal IRA permits you to preserve additional for retirement.

People great post to read today will argue that investing in what you realize will depart the standard Trader way too intensely retail-oriented, but realizing a company, or making use of its goods and services, can be a healthier and wholesome method of this sector.

The features that surface On this table are from partnerships from which Investopedia gets payment. This compensation may possibly influence how and exactly where listings look. Investopedia will not include all offers readily available while in the marketplace.

Adjustments in housing values or economic circumstances may have a favourable or unfavorable impact on issuers inside the real-estate market.

You'll be able to diversify further more by owning multiple teams of assets concurrently, like stocks and bonds. In general, bonds are more steady than shares and may increase in value when shares are doing badly. By possessing equally, you may be able to develop a far more secure and balanced portfolio.

She discovered her enthusiasm for personal finance as a fully-accredited financial Specialist at Fidelity Investments ahead of she realized she could reach more and more people by creating.

Harry Browne was an author and investment advisor who created the long-lasting portfolio investing strategy.

Of your entire work Advantages, your employer-sponsored retirement prepare might be One of the more valuable.

Alicia Silverstone Then & Now!

Alicia Silverstone Then & Now! Michael Bower Then & Now!

Michael Bower Then & Now! Bo Derek Then & Now!

Bo Derek Then & Now! Traci Lords Then & Now!

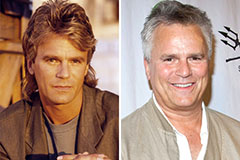

Traci Lords Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!